(€/000) | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 |

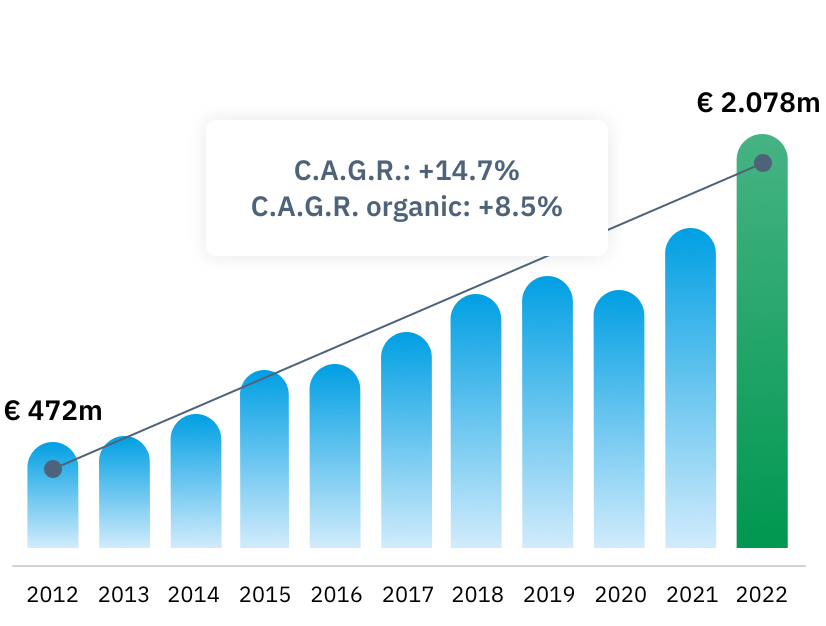

Group Net Revenues | 2,077,964 | 1,604,255 | 1,294,363 | 1,368,618 |

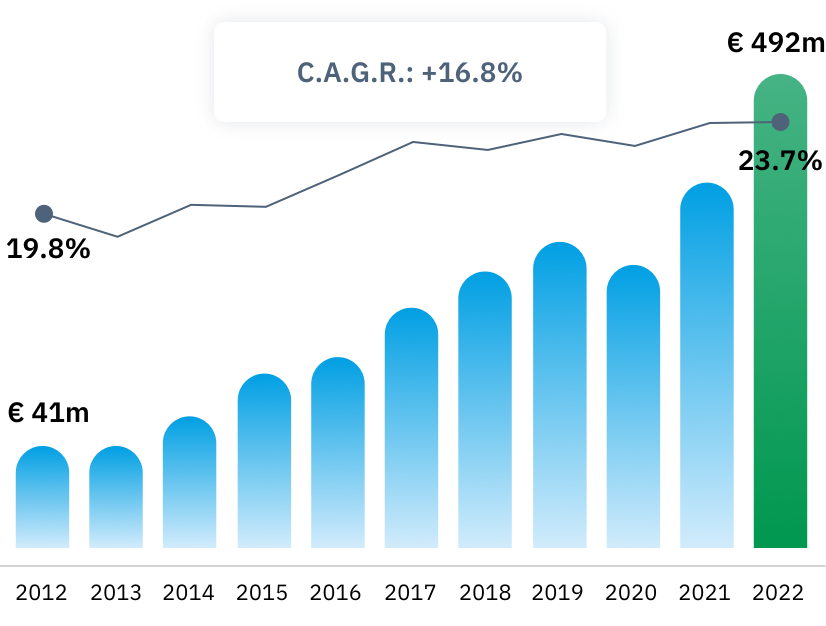

EBITDA 1 | 492,337 | 379,757 | 294,055 | 317,890 |

EBITDA margin | 23.7% | 23.7% | 22.7% | 23.2% |

EBIT 2 | 384,004 | 295,048 | 207,659 | 247,214 |

EBIT margin | 18.5% | 18.4% | 16.0% | 18.1% |

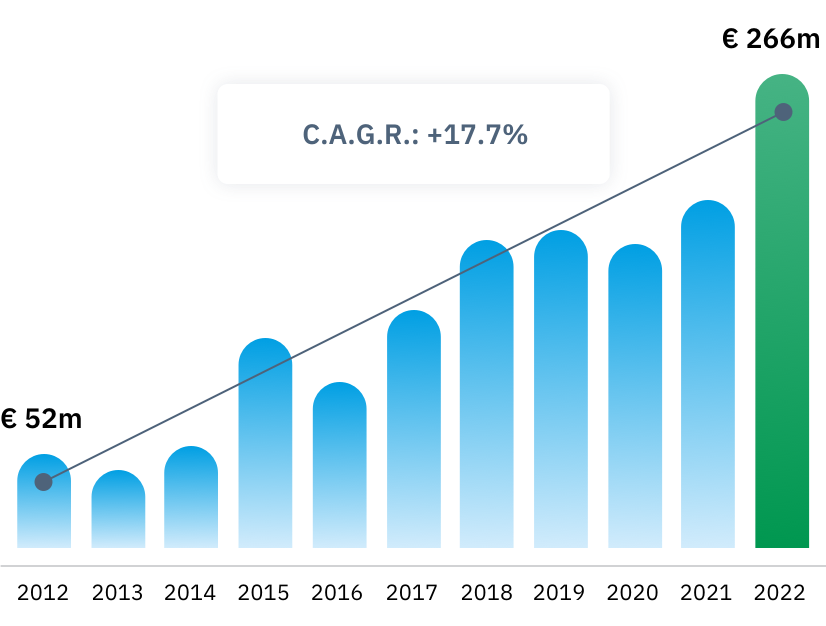

Consolidated Net Profit | 269,749 | 198,519 | 173,271 | 180,602 |

Free Cash Flow 3 | 51,100 | 133,800 | 203,769 | 124,824 |

Net Financial Indebtness 4 | 604,596 | 572,718 | 332,186 | 425,100 |

CAPEX 5 | 129,479 | 106,726 | 61,395 | 73,654 |

EPS - € | 2,524 | 1,836 | 1,596 | 1,699 |

Dividend per share 6 | 0.30 | 0.28 | 0.26 | 0.25 |

The above figures are prepared under International Financial Reporting Standard (IFRS)

1 - Earnings/(losses) before interest, tax, depreciation and amortization

2 - Earnings/(losses) before interest and tax

3 - Cash flow of operating activities less cash flow for investments in tangible and intangible fixed assets

4 - Loans obtained and Bank borrowing less Cash and cash equivalents plus debts for the acquisition of equity investments

5 - Investment in property, plant and equipment and intangible assets, net of divestments

6 - Dividends refer to the year when the distributed profits were formed